Investing Sustainably: Students Launch New Fund

Sustainability

Published May 3, 2018

A multinational package delivery company, an engineering consulting firm and a water technology provider will receive the first investments from a new $100,000 fossil-fuel-free innovation fund managed by the Smith College Investment Club.

Those were the winning stock proposals in the student club’s annual pitch competition, which this year focused on creating a portfolio that meets environmental, social and governance (ESG) standards set by club members.

The April 18 competition was a way to involve more students in finding suitable ventures for the Smith Sustainability Fund, said Natalia Kreciglowa ’18, co-president of the investment club.

“We know there is campus-wide interest in sustainable investing,” Kreciglowa said. “We wanted to reach out beyond club members for ideas about stocks that belong in an ESG fund.”

Following a recommendation of Smith’s Study Group on Climate Change, the college last fall provided $100,000 for the student-managed fund, which avoids investing in companies whose main source of revenue comes from fossil fuels, tobacco products, firearms or toxic chemicals. Investment criteria developed by students also include industry-specific standards for employee relations, worker safety and company leadership, among other issues.

Student teams gathered in Stoddard Hall to pitch investments aimed at garnering positive financial returns, as well as meeting the fund’s sustainability guidelines.

Judges for the competition—who sat in the front row, guidelines at the ready—were Michael Howard, executive vice president for finance and administration; Roger Kaufman, professor of economics; and Keith Fox, a lecturer who teaches financial accounting courses through the Jill Ker Conway Innovation and Entrepreneurship Center.

For more than an hour, the room filled with talk of price/earnings ratios, market caps, financial risks and opportunities. Students presented financial data, outlined environmental track records and answered questions about company stock performance.

At the end of the night, two pitches tied for the $300 first-place prize:

- Tetra Tech, presented by Ha Cao ’20 and Van Nguyen ’18

- Xylem water technology, presented by Aditi Aryal ’18.

The $100 third-place prize went to:

- United Parcel Service, presented by Oumayma Koulouh ’19.

Members of the winning teams were thrilled that their proposals were chosen for the fund’s inaugural investments.

Cao said investing in Tetra Tech will have a broad impact because “the company provides environmental consulting and engineering services for many government agencies and companies around the world.”

In pitching United Parcel Service—a company not often associated with sustainability—Koulouh cited UPS’s investments in alternative fuels for its vehicles. “Every portfolio should be diverse, and we need every company to be sustainable,” she told the judges.

As a biochemistry major with little exposure to finance or economics, first-place winner Aryal was initially unsure of how she would fare in the pitch competition.

“The end result was really rewarding,” she said. “It was fun learning about terms and concepts I had only heard in passing before.”

The investment club, with advising support from the Conway Center and Smith’s Office of Sustainability and Planning, will launch the new fund with $10,000 worth of stock in each of the companies selected through the pitch competition, Kreciglowa said. Club members will identify another sustainable investment vehicle for the remaining $70,000 and will publish a biannual report of the fund’s performance.

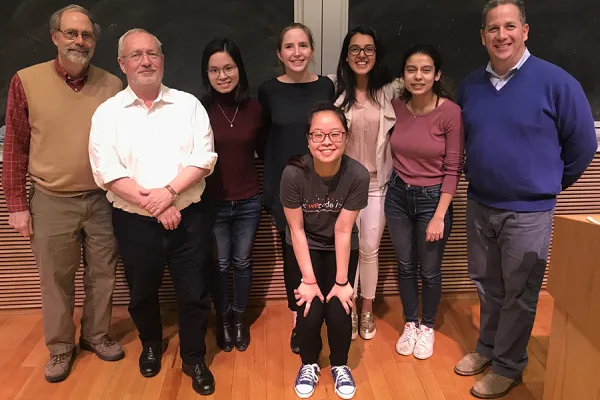

Judges and winners of this year's stock pitch competition with co-presidents of the Smith College Investment Club.